This interview was originally posted on Moneycab.com. To read the article (in German), click here.

Moneycab.com: Mr. Butz, DKSH's core EBIT margin increased from 2.8% to 3% across all four Business Units. Will the smallest but second most margin-strong Business Unit, Technology, receive special attention?

Stefan P. Butz: The Business Unit Technology looks back on a successful year 2023 and has contributed significantly to the growth of the DKSH Group. We have a leading market position in Asia Pacific, a high-quality product and service portfolio, and a focused growth strategy. Due to the operational margin, which is more than twice as high as that of the DKSH Group, this area will remain important for us in the future.

In 2023, you acquired Partizan Worldwide in the Healthcare Solutions sector in Australia and Bio-Strategy, the largest independent distributor of scientific instruments in Australia and New Zealand. Will the South Pacific region continue to develop most strongly?

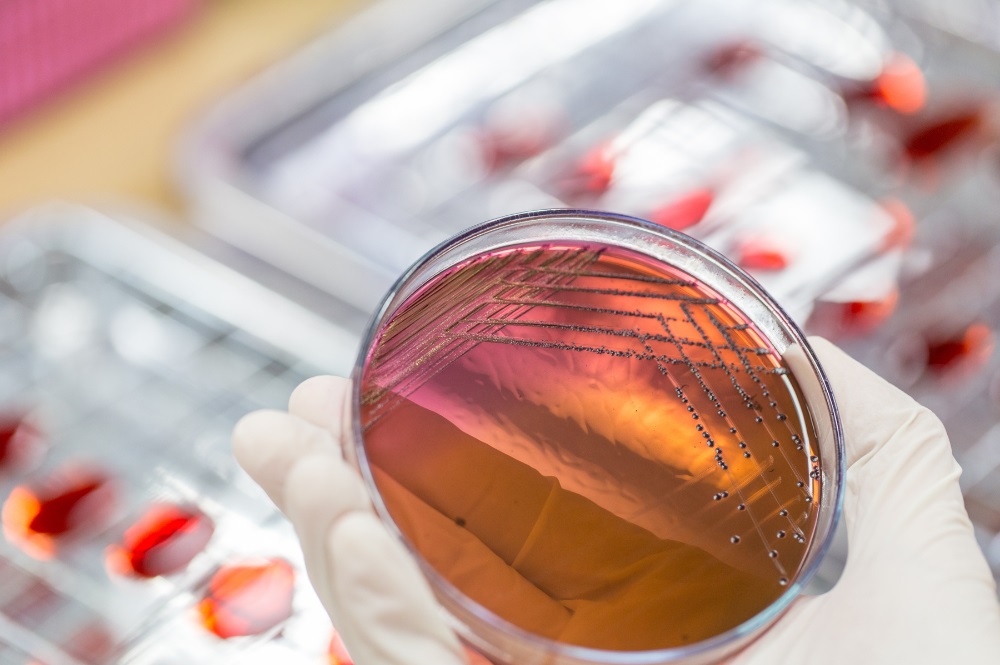

Since 2019, we have continuously expanded our market position through organic growth and targeted acquisitions in Australia and New Zealand. Both Partizan, as a provider of specialized patient solutions, and Bio-Strategy, as a distributor of scientific instruments, offer products and services that complement our existing portfolio and generate added value for our customers. We see good growth potential and will continue to expand our market position in Australia and New Zealand as an integral part of Asia Pacific.

In the last five years, DKSH has made almost two-thirds of its acquisitions in the Performance Materials business sector, whose core EBIT margin increased from 7.9% to 8.7%. Were there particularly favorable opportunities?

Indeed, we have made over 60 percent of M&A investments in the Performance Materials business sector. The global specialty chemicals distribution market is very large and growing, estimated at over EUR 220 billion, but still highly fragmented. The five largest distributors hold a market share of only around ten percent. At the same time, chemical producers are outsourcing more and more activities and reducing the number of distributors they work with. This enables many interesting acquisition opportunities.

Therefore, since 2019, we have conducted 10 acquisitions in this area, expanding our business regionally, diversifying our manufacturer and customer portfolio, and complementing our portfolio with value-added services and ingredients. Thus, we pursue the strategic goal of expanding our position as a global player.

You are particularly optimistic about Thailand in 2024. What profit contribution do you expect from this "DKSH homeland"?

We are positive about the Thai market. We were very successful last year and grew by over five percent at constant exchange rates. Supported by the resurgence of tourism in the country, market experts expect a higher gross domestic product in 2024 than in the previous year. Therefore, we expect Thailand to continue to make a good profit contribution to our business in 2024.

While net profit fell slightly in 2023, Free Cash Flow increased by a very good 37 percent. Thus, DKSH has enough resources for the next expansion steps. Where outside of Asia/Australia will this happen?

Core EBIT growth was over 12 percent at constant exchange rates. With our strong cash flow and balance sheet, we are able to conduct further value-enhancing acquisitions. In the specialty chemicals sector, we operate globally. The market offers significant consolidation potential, which is why we are looking at acquisitions in Asia Pacific, Europe, and North America.

You celebrated 100 years of market presence in Malaysia and Hong Kong. How do your employees cope with the political climate there?

We work with almost 100 percent local employees who know the situation on the ground. In addition, DKSH is known for reliably distributing essential consumer goods and pharmaceuticals to the population in these markets, even in difficult times.

You also expect headwinds from the currency front in 2024, ranging from three to five percent. Isn't there an “upside”? After all, the Swiss franc is considered overvalued by some analysts.

It is difficult for us to predict exactly how exchange rates will develop by the end of the year. However, in recent weeks, the Swiss franc has weakened somewhat, which should have a positive effect on our business.

I assume you will continue to hedge the dollar next year for your Business Units Performance Materials and Technology?

That's correct, we have established hedging processes to minimize currency risks for our project transactions in the Business Units Performance Materials and Technology. Otherwise, we trade the products we distribute in the same currency, which serves as a natural hedge.

Last year, DKSH converted an existing bank loan of CHF 315 million into a sustainable loan. The interest conditions are now linked to sustainability goals. By how many basis points does this improve the interest burden?

The conversion of our existing bank loan into a sustainable loan demonstrates that we are consistently pursuing our ambitions in the field of sustainability. The sustainability goals of the loan are directly linked to our sustainability strategy. We expect that by achieving our sustainability goals, we can contribute a manageable but pleasing amount to our Group result.

The equity ratio is 31.8%. I assume it will continue to rise?

Our business model is capital-light, with investments averaging only 0.4 percent of revenue in recent years. This generates a consistently high cash flow, which favors a high equity ratio. We expect a good equity ratio in the future as well.

For the first half of the year, you expect some headwinds due to the global economy. The second half should be good for all of us. Does this also apply to Europe?

We are generally confident about the potential in Asia Pacific and remain well-positioned to benefit from favorable market, industry, and M&A consolidation trends. Market experts also foresee economic growth in Europe in 2024, which benefits our Business Unit Performance Materials.