-

Consumer Goods

- Overview

- Industries

- Services

Services

Access a full range of integrated solutions to support your business growth.

- Insights

Insights

Stay updated with our latest insights on Asia and beyond.

-

Healthcare

- Overview

- Industries

- Services

- Insights

Insights

Stay updated with our latest insights on Asia and beyond.

-

Performance Materials

- Overview

- Industries

- Services

- Insights

Insights

Stay updated with our latest insights on Asia and beyond.

-

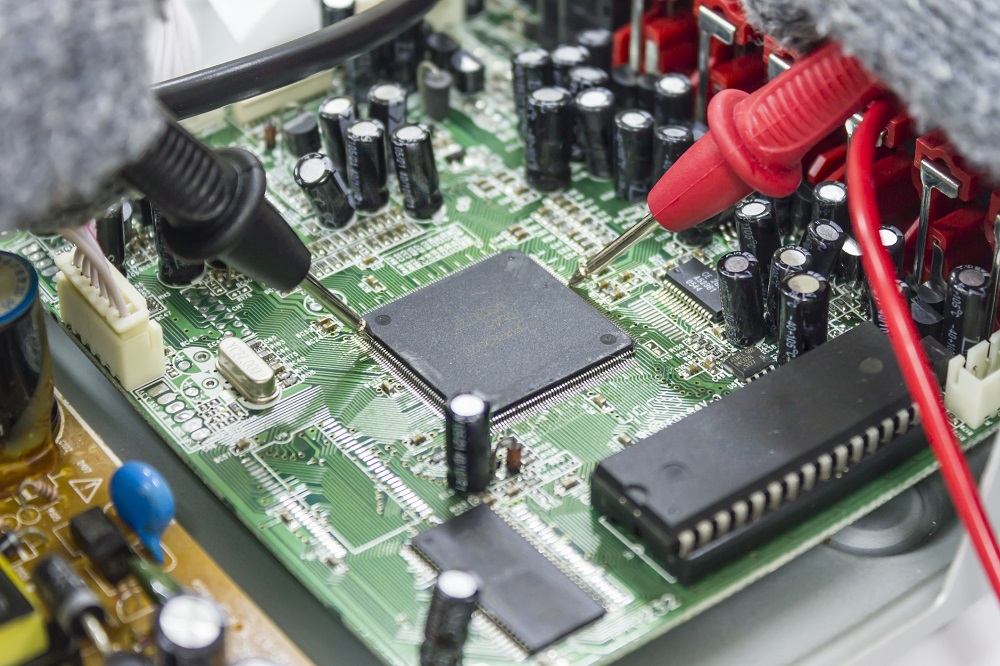

Technology

- Overview

- Industries

- Services

- Insights

Insights

Stay updated with our latest insights on Asia and beyond.

- Our products

Our products

Search our product database.

-

Services

- Overview

- Sourcing

Sourcing

Accessing a global sourcing network.

- Market insights

Market insights

Generating ideas for growth.

- Marketing and sales

Marketing and sales

Opening up new revenue opportunities.

- Distribution and logistics

Distribution and logistics

Delivering what you need, when you need it, where you need it.

- After-sales services

After-sales services

Servicing throughout the entire lifespan of your product.

- Digital & IT Backbone

DKSH CSSC

Learn about our global hub for Digital & IT services.

- Insights

- Home

- Insights

- Our expertise

- Get ready for Industry 4.0, three things to consider

- Home

- Insights

- Our expertise

- Get ready for Industry 4.0, three things to consider