- Food Science

-

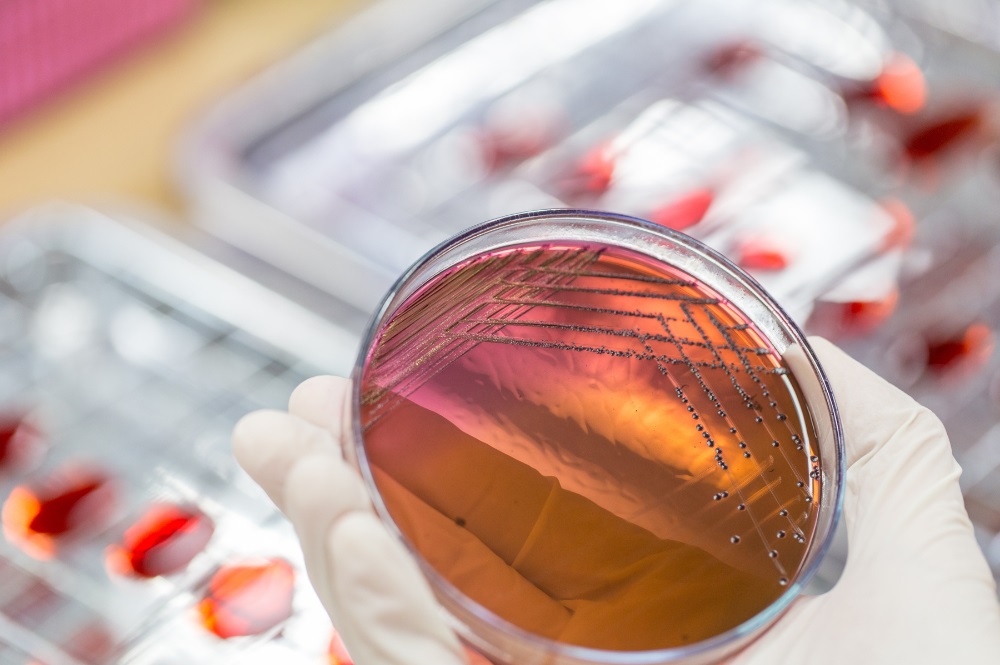

Life Science

- Overview

- Cell Analysis

- Clinical Diagnostics

- Genomics

- Biopharma Solutions

- Lab Automation

-

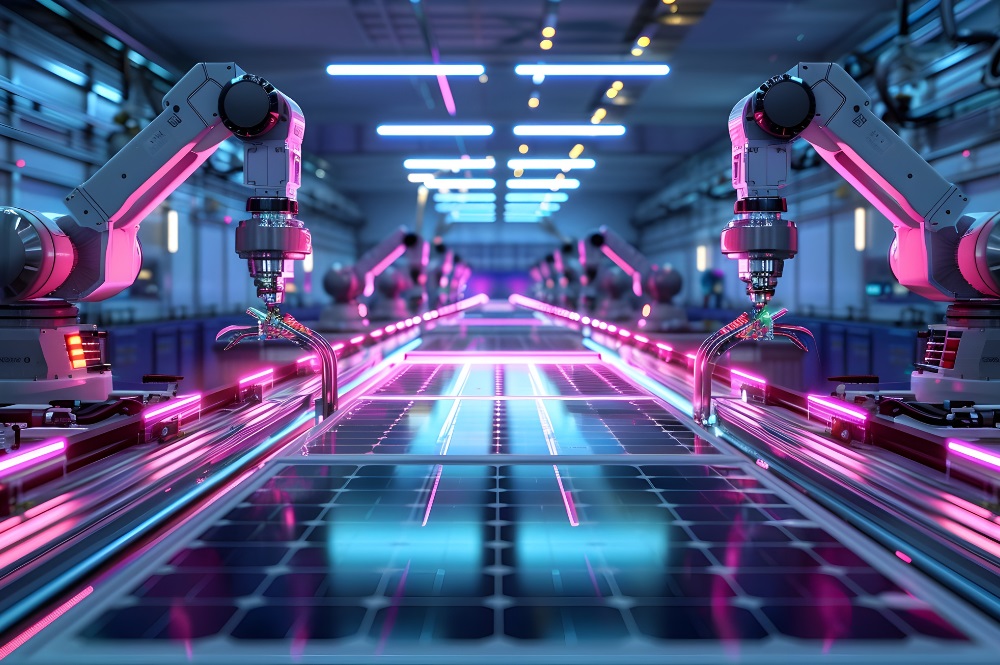

Material Science

- Overview

- Industries

- Microscopy

- Particle Characterization

- Viscosity & Rheology

- Thermal Analysis

- Stability

Stability

Dispersions are unstable from the thermodynamic point of view; however, they can be kinetically stable over a large period of time, which determines their shelf life

- Surface Science

- Material Testing

Material Testing

Nav Desc

-

Pharmaceutical

- Overview

- Research and Development (R&D)

Pharmaceutical Research and Development (R&D)

The pharmaceutical R&D cycle is a complex and lengthy process that involves the discovery, development, and commercialization of new drugs. The entire cycle can take more than a decade and involves various stages, from basic research to clinical trials and regulatory approval.

- Pharmaceutical Quality Control

- Testing Services

- Products

- Insights

-

About us

- Overview

- News

News

Check the latest news from DKSH and our partners: new products, innovations, updates, etc.

- Who We Are

About DKSH Center of Excellence

The Center of Excellence, DKSH Technology is a regional hub for APAC in developing technical and application expertise for a wide range of leading scientific instruments.

- Contact Us

Contact DKSH Specialists

Get in touch with us and our expert support team will answer all your questions.

.jpg)